Overview

- Multifamily over 4 Units

- 4

- 7.00

- 3175

- Moderate+

- Estimated Rehab Cost

- Saginaw

- County

Description

Asset Class: C-Class Multifamily

Total Units: 7

Occupancy: 42.8% (3 of 7 units currently occupied)

Utilities: Electric is separately metered (Tenant Paid). Heating (Boiler/Gas) and remaining utilities are Landlord Paid (Avg. $400/month).

Access: Do not disturb tenants.

Value-Add / Stabilization:

Asset is underperforming at 42.8% occupancy. Strategy requires turning the 4 vacant units and placing tenants to stabilize the asset and maximize yield.

MSHDA Strategy:

Opportunity to utilize Michigan State Housing Development Authority (MSHDA) vouchers for guaranteed government rent disbursements upon stabilization, reducing delinquency risk.

💰 Financial Breakdown & Yield Analysis

Acquisition Price: $225,000 ($32,142 / Door)

Pro Forma Gross Annual Income (GAI): $51,060 ($4,255 / month at 100% occupancy)

Landlord Utility Expense (Actuals): $4,800 / year ($400 / month)

Pro Forma Net Operating Income (NOI): $28,083 / year

Pro Forma Cap Rate: 12.48%

Details

- Price: $225,000

- Property Size (Sq. ft.): 3175

- Land Area (Acres): 0.34

- Bedrooms: 4

- Bathrooms: 7.00

- Garage: Open Parking

- Property Type: Multifamily over 4 Units

- Property Status: Cash Flow

- County: Saginaw

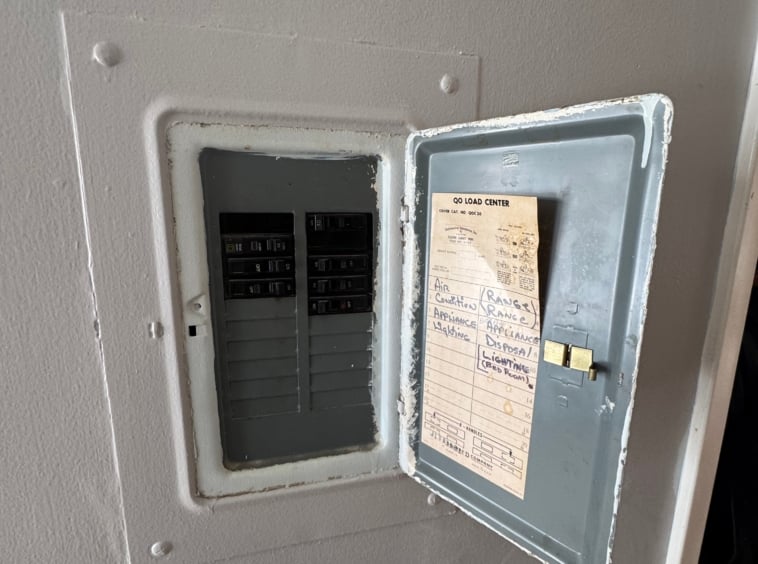

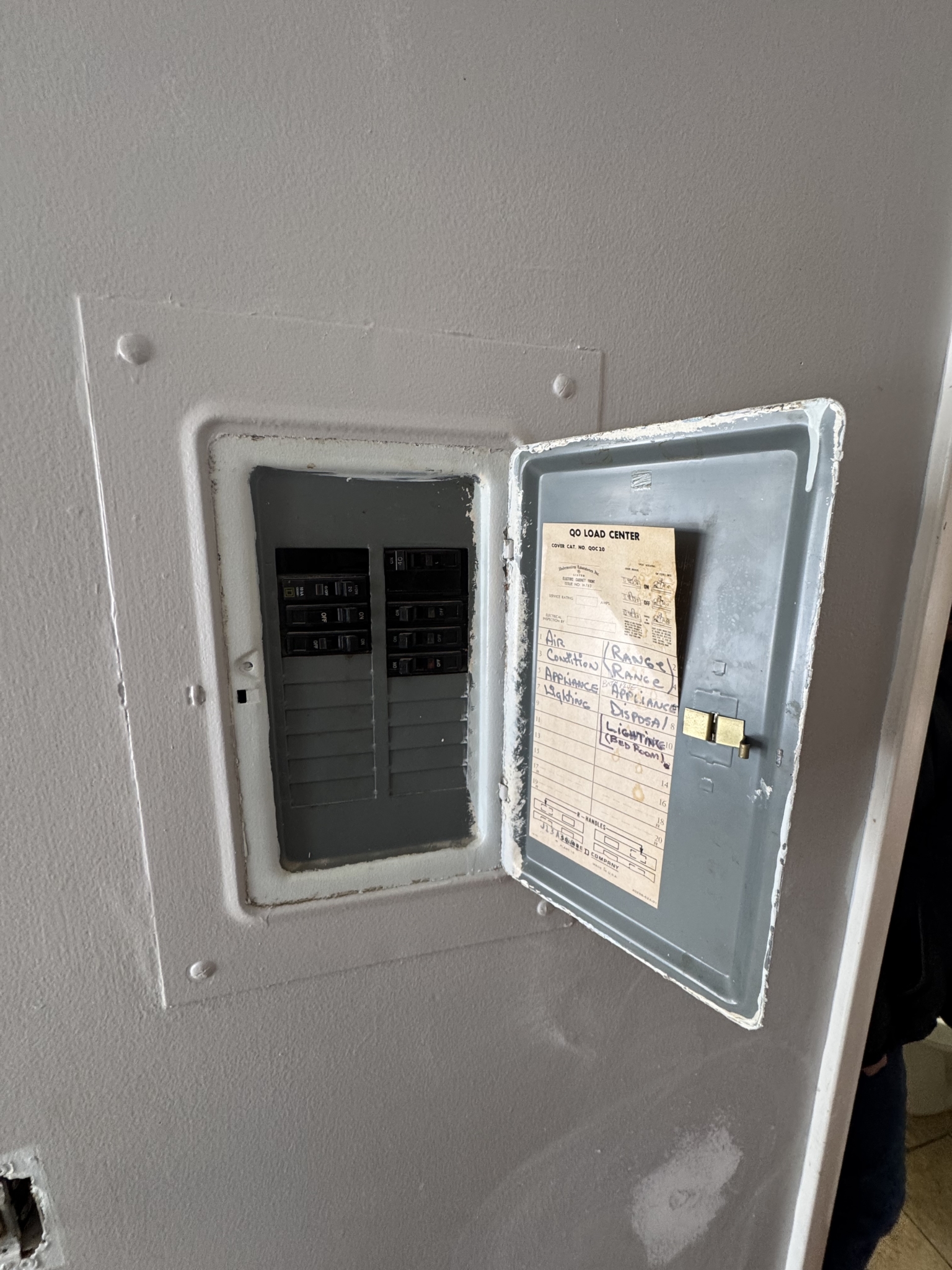

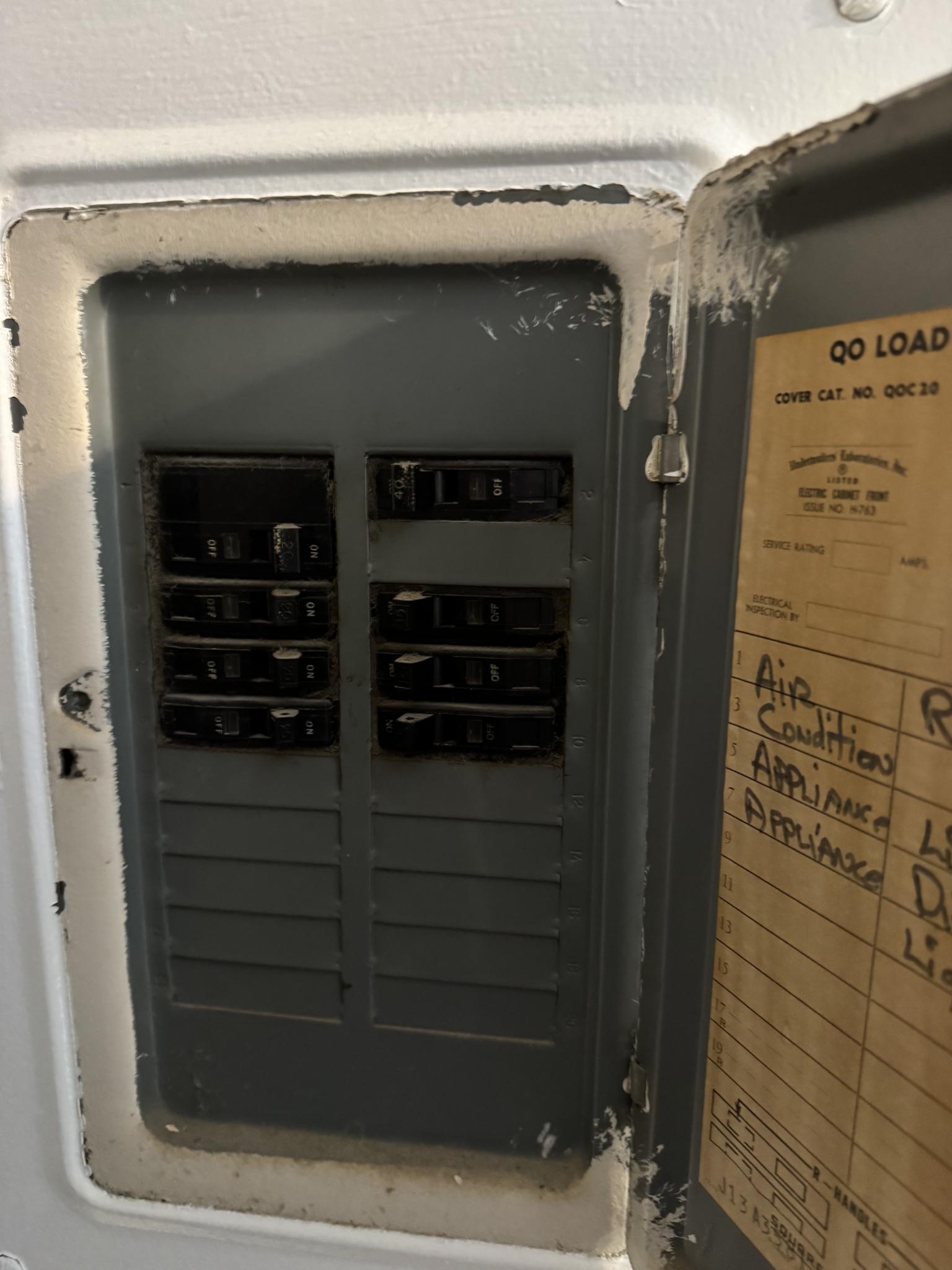

- Estimated Rehab Cost: Moderate+

- Estimated Monthly Rent: See Description

- Yearly Taxes: $4,740

- HOA Monthly Cost: $0

- Construction Type: Frame

- Pool: None

Similar Listings

Mortgage Calculator

- Principal & Interest

- Property Tax

- Home Insurance

- PMI